In the past 12 months, the global economy ground to a halt and markets experienced their sharpest drawdown in history but ended with the S&P 500 up ~17% for the year. Markets once again proved resilient, buoyed by extraordinary measures taken by monetary and fiscal authorities across the globe.

We see 2021 being a year of recovery in the economy as it plays catch-up with financial markets. With the following themes paving the way:

- Global output and demand are likely to rebound strongly in 2021

- We believe investors should expect returns to moderate over the next full market cycle (5-7 years) as the financial markets have, to an extent, priced in an economic recovery

- Change in market leadership

- Opportunities in private markets

Economic Rebound:

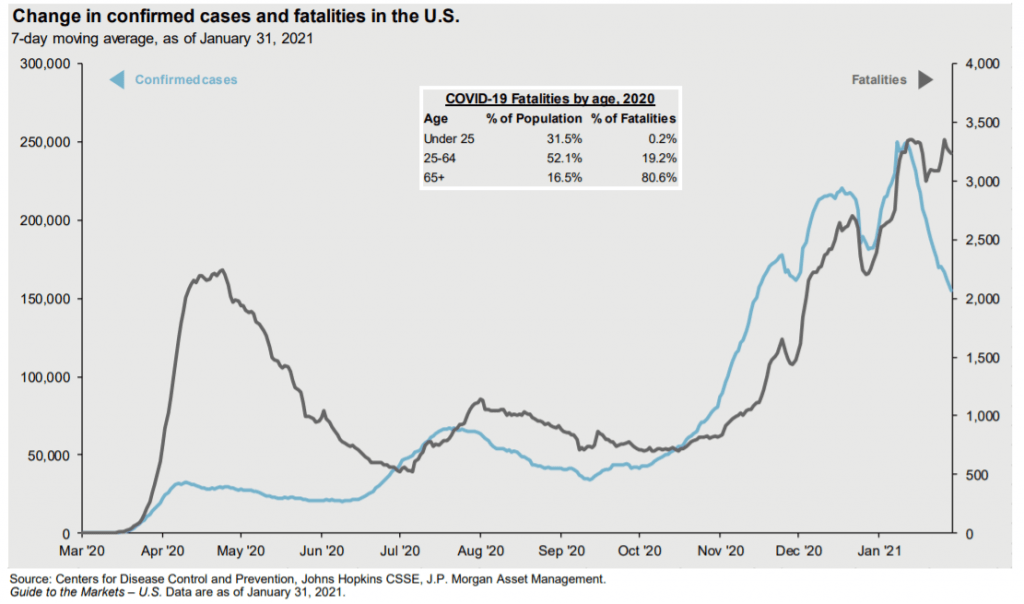

After conquering the daunting task of developing a vaccine in record time and then getting off to a rocky start with distribution, we are seeing signs of logistical improvement with appointment availability opening and the average rate of administered vaccinations reaching nearly 1.5mm Americans per day according to CDC data.

With mortality rates around 80%, the most vulnerable cohort—individuals over 65—are expected to continue falling as the group is largely vaccinated by the end of the first quarter of the year.

While the vaccine effort progresses, Central Banks around the world are keeping interest rates lower for longer and federal governments are providing significant stimulus for main street. This also tends to push up asset prices which benefits investors.

A change in leadership at the Federal government level implies strong support for main street stimulus, as well as an expectation of easing global trade tensions exemplified by the United States rejoining the Paris Climate Agreement. Moreover, with Brexit largely behind us we see favorable conditions for international trade moving forward.

Cautious Outlook:

We believe the swift recovery in public equity and credit markets last year indicated that the market has, to an extent, priced in an economic recovery. The large amount of liquidity in the market has investors looking towards less traditional investments. Special Purpose Acquisition Companies (SPACs) bringing non-revenue generating early-stage companies public is an area we are keeping a close eye on for signs of excess. As a result, we see this as a time for careful portfolio positioning while looking towards areas of the market with more attractive valuations.

Change in Market Leadership:

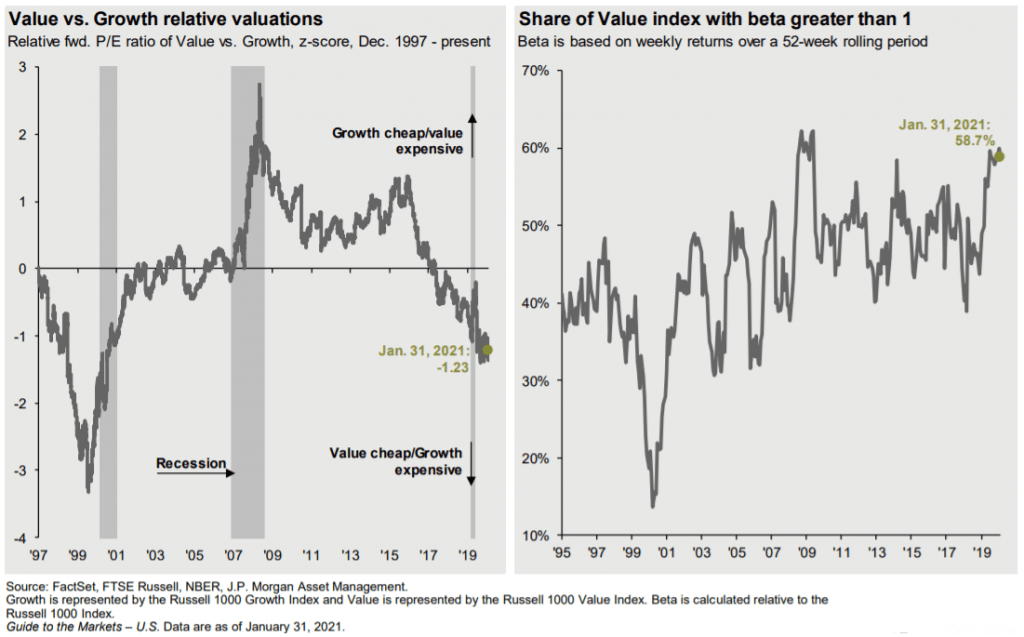

Rather than growth and technology stocks leading the charge, as they have in the last 12 months, we expect the rest of the market to start improving with more cyclical and value stocks pulling ahead with strong earnings growth as the economy reopens. Travel and leisure, in particular, stand to benefit from the economy’s reopening as vaccines become more widely available.

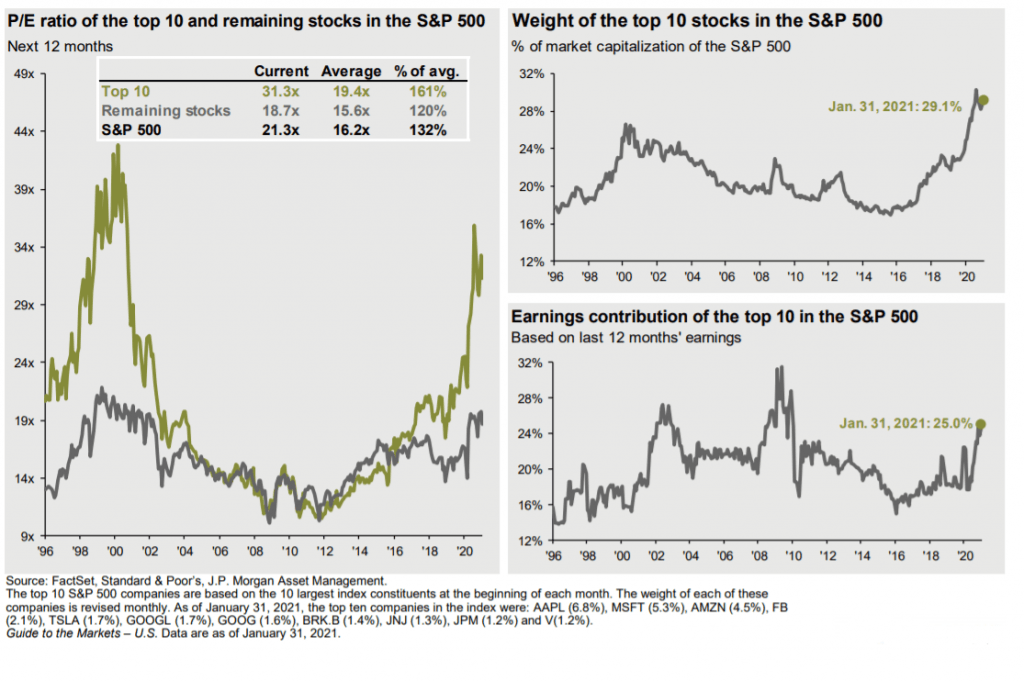

Recent data shows indices like the S&P 500 are heavily skewed towards technology stocks creating a sector imbalance. Currently, the top 10 holdings in the S&P 500 account for almost 29% of the total index, which is historically more than their fair share. Simply put, the names that got us through the COVID-19 recession are unlikely to lead us through the next phase of the cycle.

The current monetary & fiscal landscape gives reason to believe that the US dollar will face continued downward pressure as interest rates remain lower for longer. Generally, a weaker dollar creates a favorable environment for international equities, which also happen to be cheaper in comparison to their US-based peers currently. Both the weaker dollar and relative cheapness of international securities make international stocks an attractive investment. These circumstances inform our view that small companies, international stocks and cyclical equities could perform well on a relative basis through the next phase of this investment cycle.

Private Markets:

Private market assets could play a role to lower volatility and provide higher returns than traditional fixed income. With yields in bonds expected to remain lower for longer, we believe strategic private market assets are an interesting place to look. There may be opportunities in private equity, credit, real estate, and infrastructure that can offer a higher yield with relatively lower volatility than public equity markets.

One of the most crucial trade-offs between public and private assets is liquidity. Meaning it is far easier to buy and sell a stock or ETF through an online broker than it is conducting a transaction in private markets. However, lower liquidity could be a reasonable tradeoff for certain investors.

Conclusion:

It is important to keep in mind that financial markets are forward-looking while data from the economy tends to be retrospective. While we are constructive on prospects of recovery in the economy, we remain cautiously optimistic about market returns in the next phase of this market cycle. More balanced diversification across the market sectors is our basis for a prudent long-term investing approach.

DISCLAIMER

The information in the presentation is not intended to provide and should not be relied upon for accounting, legal and tax advice or investment recommendations. Callan Capital does not provide individual tax or legal advice, nor does it provide financing services. Investors should review planned financial transactions and wealth transfer strategies with their own tax and legal advisors. Callan Capital outsources to lending and financial institutions that directly provide investors with, securities based financing, residential and commercial financing and cash management services. For more information, please refer to our most recent Form ADV Part 2A which may be found at www.adviserinfo.sec.gov.

Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. The views contained herein are not to be taken as an advice or recommendation to buy or sell any investment in any jurisdiction. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without previous notice. All information presented herein is considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to any error or omission is accepted. This information should not be relied upon by you in evaluating the merits of investing in any securities or products mentioned herein

PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS and does not guarantee future positive returns

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. This world-renowned index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. An investor cannot invest directly in an index.