The stock market is off to its strongest first half start in over 20 years with the S&P 500 up 16.07% as of July 9th, 2021. The economy is also seeing improvements largely driven by a combination of improved vaccination statistics, economic reopening and two stimulus packages worth $2.8 trillion.

So far, our year of the recovery thesis described in our Q1 outlook is coming to fruition and we do not see it drastically changing. But rather than check-in on our previous outlook, our focus is now on the following narratives:

- Stimulus, Act II

- Inflation

- An Update on Biden Tax Proposals

Stimulus, Act II:

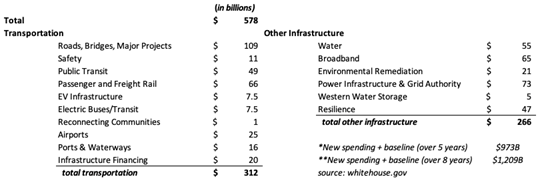

After months of negotiations across the halls of congress, an agreement—albeit tentative—is in place for a $1.2 trillion Bipartisan Infrastructure Framework. Details below:

Data as of July 13th, 2021

The emphasis on getting it done now is due to an amalgam of factors, namely: historically low interest rates allowing manageable debt-servicing costs, infrastructure-related scares (See: Texas’s ongoing power grid troubles, historical drought in the Southwest United States, New York City’s energy conservation request, and the Colonial Pipeline hack), and a general consensus across the aisle that something must be done. Economists with market analytics firm S&P Global assert that “infrastructure, if chosen wisely, may be a long-term solution, providing the productivity boost needed to help get the U.S. expansion back on track” adding that a well-reasoned infrastructure bill “would likely add a cumulative $1.3 – $1.8 trillion to GDP by 2027.” Such targeted spending bolsters our country’s infrastructure while creating millions of jobs and facilitating future economic growth. Opponents of further government spending often cite concerns over inflation as a major reason to pull back on spending. However, leadership at the Federal Reserve remains steadfast in their view that inflationary pressures are transitory in nature.

Inflation:

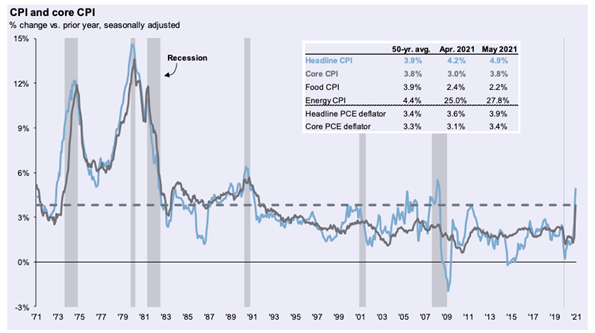

Whether it’s on the news, social media or if you’re in the process of building a home you are likely aware of the latest discourse around inflation. But the difficulty with inflation is that it’s causes are tough to pinpoint. Thinking back to the last crisis in ’08, many pundits, economists and market forecasters predicted rampant inflation in the years to come due to the stimulus response to the housing crisis. Taking a look below we see that although we experienced a short-term spike in inflation following the ’08 crisis, inflation subsequently trended lower the following decade.

Source: JP Morgan Guide to Markets June 30th, 2021

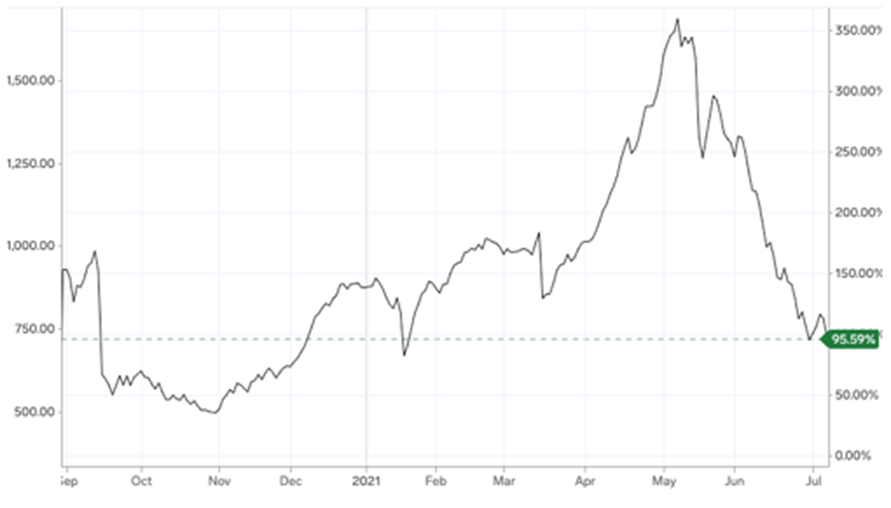

Admittedly, the world in 2008 looked much different than 2020, with the obvious difference being COVID-19. But taking a look at the knock-on effects of a world shut down reveals a global supply chain crisis. Discrepancies in policy responses and vaccination rates have caused an unequal recovery, especially for smaller emerging markets where manufacturing’s off shored by global corporations. Such disruptions cause supply-demand imbalances across a variety of goods, resulting in demand outpacing supply. The idea that inflation is transitory stems from the perspective that as the world reopens and smaller markets catch-up to the US, this imbalance starts to resolve itself. A good example of this phenomenon is the price of lumber, a primary input for homebuilding. The chart below shows a significant increase followed by an equally steep decrease in costs

Figure 2: Price of Lumber; as of July 9th, 2021

(source: https://markets.businessinsider.com/commodities/lumber-price)

It’s with this backdrop in mind that Federal Reserve policy makers maintain the view that inflation is transitory, but they’re prepared to act should the data reveal cause for concern. For now, the Fed’s signaling an interest rate hike in late 2022 or early 2023. The likelier policy change in the months ahead is the Biden administration’s tax agenda.

An Update on Biden’s Tax Proposals:

Our primary focus across the broad-ranging tax proposals set forth by the Biden administration is on policies affecting personal income tax, pass-throughs and Estate & Gift taxes. In May, the U.S. Treasury released a 114-page document outlining provisions for amending laws surrounding trust & estate tax. Some of the proposals highlighted by the National Law Review include:

- Treat death and gifts of appreciated property as realization events that require gain to be recognized as if the underlying property was sold, subject to a $1 million lifetime exclusion. Gains on gifts or bequests to charity or to a surviving spouse would be excluded from tax but the basis would carry over.

- Treat all pass-through business income of high-income taxpayers as subject either to the 3.8% net investment income tax (“NIIT”) or the 3.8% Medicare tax under the Self-Employment Contributions Act (“SECA”).

- Increase the long-term capital gains rate and qualified dividend income rate to 39.6% (43.4% including the net investment income tax) from 20% (23.8% including NIIT to the extent the taxpayer’s income exceeds $1 million, indexed for inflation. This proposal is proposed to be effective retroactively for gains and income recognized after April 28, 2021.

Other proposals not included in Treasury’s report but likely to change include lowering the lifetime estate tax exemption from the current $11.7M per-person to as low as $3.5M per-person, as well as increasing the top estate tax rate to 45%. The likelihood of all, or even most, of these changes is unknown. But it’s best to prepare for potential changes sooner rather than later to be in the best position possible to manage what lies ahead. Consulting with your team of financial advisors, estate lawyers and CPA is paramount in the weeks and months ahead.

Conclusion:

While the economy continues to propel ahead it is important to take note of potential bumps in the road. As COVID variants pop up across the globe vaccination efforts are imperative for a sustained global recovery. With markets fully recovered from the pre-COVID sell-off and a critical infrastructure bill hanging in the balance, we remain constructive about the next phase of this market cycle. Our primary focus in the near-term is ensuring our clients are well-positioned for potential changes in tax policy.

Disclaimer:

The information provided is for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Callan Capital Management’s views as of the date of distribution. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. Callan Capital Management does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. Callan Capital Management has obtained the information provided herein from various third-party sources believed to be reliable but such information is not guaranteed. Certain links provided connect to other Web Sites maintained by third parties over whom Callan Capital Management has no control. Callan Capital Management makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Callan Capital Management is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of Callan Capital Management. For detailed information about our services and fees, please read our Form ADV Part 2A, and our Form CRS which can be found at https://www.advisorinfo.sec.gov or you can call us and request a copy at (866) 912-4888