2021 began with the promise of vaccines and a belief that everything would return to “normal” after a turbulent year due to the pandemic. Over the past 12 months, we have seen historic price spikes for companies and consumers, acute labor shortages across industries, and an ongoing bottleneck in the global supply chain that continues to this day. However, after a slow start this quarter, growth quickened at the end of 2021 and is expected to continue strong as re-openings resume and companies try to rebuild inventory. Despite the many curveballs thrown by the COVID-19 pandemic, consumers are learning how to adapt to ever-changing conditions and remain financially healthy with job growth and increased wages.

COVID-19

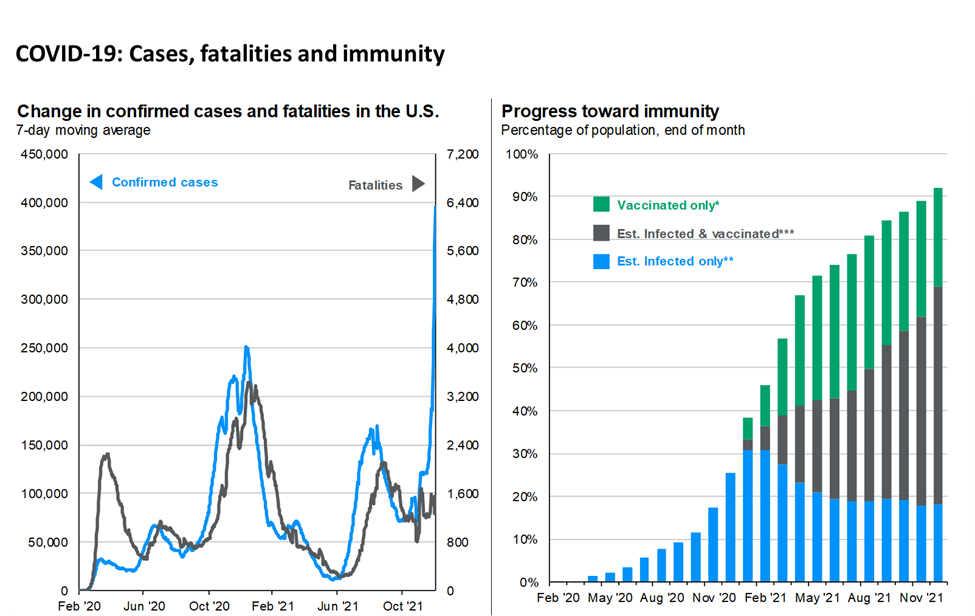

There are plenty of factors to watch as we move into 2022. First and foremost, the COVID-19 pandemic is still present and weighs heavy on investors’ minds. As the fourth quarter progressed, investors saw market risk shift to a new coronavirus variant from South Africa. Like the Delta variant, Omicron shocked the markets and caused lockdowns to resume in many parts of the world. Fortunately, a national uptick in vaccination rates [including booster shots] have allowed for a reduced infection rate, hospitalization stay, and an overall milder case for those with the Omicron variant. This should lead to fewer cases and, moreover, fewer fatalities over the coming months. In addition to the business disruptions the pandemic caused, there was also a strain on healthcare, education, and travel. Moreover, the pandemic is continuing to cause product shortages and supply chain disruptions. This has driven up product demand resulting in the increase pricing of goods and shipping costs, in combination with labor shortages contributing to storage surpluses and a lack of truck drivers.

Supply Chain and Inflation

This year demand for many products increased beyond the capacity of the world economy to supply causing businesses to struggle, and sometimes fail, to meet consumer demand and investor expectations. There were many factors contributing to the global supply chain’s disruption, including cutbacks in production prompted by the COVID-19 pandemic, the growing demand for goods, and labor shortages that led to delays at ports and across the transportation sector.

Many companies have cited a challenging labor environment, including higher labor costs, which has not only pushed them to cut margins, but also created inefficiencies within their operations. By mid-October, most S&P 500 companies had warned investors they would be impacted by supply chain issues, leading to lower profits and revenues.

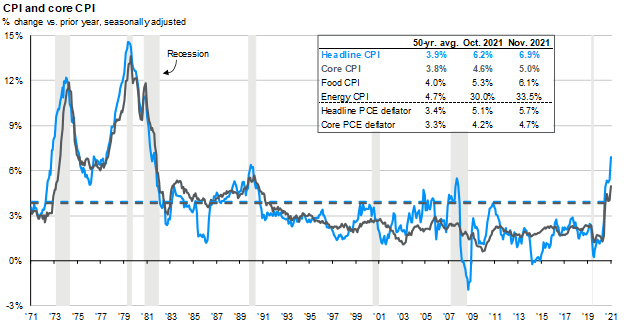

The price of goods and services has risen significantly this year as consumer spending has outpaced supply shortages across major sectors of the economy. U.S. household net worth has grown tremendously because of strong employment gains, rising wages, government transfers, and booming stock and real estate markets. In November 2021, the US 12-month CPI inflation rate reached its highest level in the US in nearly 40 years at 6.8 percent. The indexes for gasoline, shelter, food, used cars and trucks, and new vehicles were among the larger contributors. Airline fares also increased in November, rising 4.7 percent from October after declining over the previous few months as people geared up for holiday travel. More than half of the month-over-month increase in the CPI was due to price increases in cars and energy. Energy index measures were up 3.5 percent in November, while gasoline measures were up 6.1 percent.

Many aspects of the recent inflation surge appear to be transitory, specifically in terms of energy and supply chain issues. It is expected that base-year effects will help reduce inflation rates from current 30-year highs, and there are signs that some of the most extreme supply-related pressures are dissipating. Worker shortages should subside as more employees re-enter the labor force. Nevertheless, labor markets will remain tight enough to maintain solid wage growth, which will limit the downward trend of inflation rates. We see inflation settling at levels higher than pre-Covid whenever these supply bottlenecks ease.

The Federal Reserve

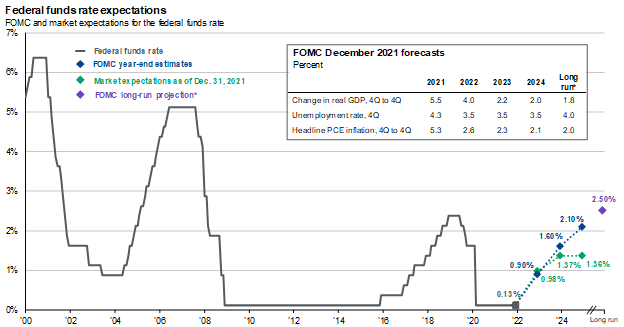

As we move into 2022, the Federal Reserve is expected to raise interest rates to fight inflation. At the December Federal Open Market Committee (FOMC) meeting, the Fed accelerated the pace of tapering by $30 billion per month, suggesting they would conclude the process by March 2022. The median forecast of FOMC members now calls for three rate hikes in both 2022 and 2023, with a terminal rate of 2 percent – 2.25 percent by 2024. The Fed’s key rate, currently at near zero, influences many consumer and business loans, including those for mortgages, credit cards and auto loans.

Policy makers expect the U.S. economy to grow 4% in 2022 and unemployment to fall to 3.5% by year-end, according to the Fed’s latest growth forecast, a key criterion for the Fed before it lifts rates of zero, where they have been since March 2020 at the start of the pandemic.

A rising number of Coronavirus variants and severe supply shortages have made the road to pandemic recovery more challenging than anticipated. After slowing in the fall, growth re-accelerated at the end of 2021 and is expected to continue strong as reopening’s resume and companies try to rebuild inventory. Despite the many curveballs thrown by the COVID pandemic, consumers are learning how to adapt to ever-changing conditions and remain financially healthy with job growth and increased wages.

Disclaimer

The information provided is for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Callan Capital Management’s views as of the date of distribution. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. Callan Capital does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. Callan Capital has obtained the information provided herein from various third-party sources believed to be reliable but such information is not guaranteed. Callan Capital makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Callan Capital is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of Callan Capital Management. For detailed information about our services and fees, please read our Form ADV Part 2A, and our Form CRS which can be found at https://www.advisorinfo.sec.gov or you can call us and request a copy at (866) 912-4888