How Callan Capital Helps Articulate the Mission, Vision, and Values of Founding Members

As a true boutique firm, with vast experience catering to the wealth management needs of our clients in our multi-family office, Callan Capital plays a crucial role in assisting families with diverse financial needs. Beyond financial management, we recognize the significance of guiding families through the realms of family governance and philanthropy, offering tailored support that aligns with their values and aspirations. With a professional methodology, we strive to provide personalized guidance to families, equipping them with the tools and knowledge needed to manage their wealth proficiently, shape their legacy, and make a meaningful societal impact through philanthropy.

Family governance in philanthropy is more than just giving; it’s about strategic, sustainable change.

Serving as the foundation of philanthropic efforts, it aligns values, visions, and resources across generations to create a lasting legacy. This article delves into the crucial role of family governance in philanthropy and its impact on societal change.

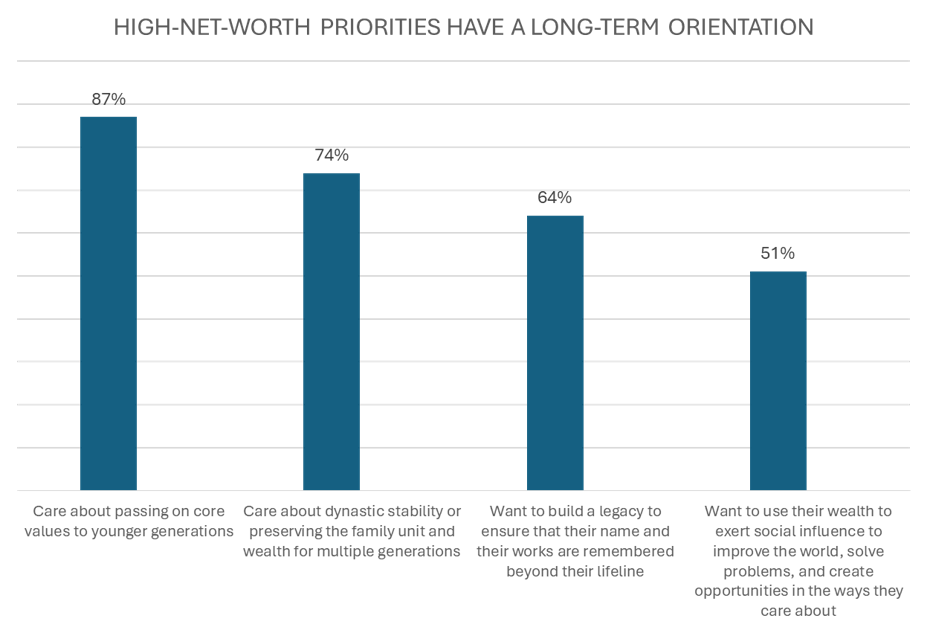

Figure 1 *N Values: Goals = 114, Stability = 81, Legacy = 121, Influence = 12 Source: Why Charitable Expertise Should Be Part of Your Practice, “Foundation Source, https://foundation source.com/resources/white-papers/why-charitable-expertise-should-be-part-of-your-practice

Beyond investors’ objectives for their assets lie their long-term priorities and aspirations for their families, which form the foundation for a significant and enduring legacy.

- Nearly nine out of ten aim to impart their core values to the upcoming generations of their family (see Figure 1).

- Three-quarters express the desire to sustain the family unit and its wealth for at least five generations.

- Almost two-thirds seek to establish a personal or family legacy that guarantees remembrance of their names and contributions beyond their lifetime.

- Approximately half intend to utilize their wealth to make a social impact and leave a positive mark on the world.

Family governance provides a platform for educating future generations about philanthropy and responsible stewardship.

Involving younger family members in discussions and decision-making processes imparts invaluable lessons about empathy, compassion, and social responsibility. This intergenerational exchange not only strengthens family bonds but also ensures continuity in philanthropic efforts across successive generations.

To involve family members of all ages in a charitable family account, consider the following strategies:

- Employ family members across diverse roles.

- Provide volunteer opportunities that can be filled part-time or on a rotational basis.

- Rotate family members through positions on the charitable family account’s “board of directors.”

- Implement discretionary grantmaking, allowing the board and/or family members to independently allocate funds without requiring board consensus. This flexibility supports causes that may fall outside the charitable family account’s usual focus areas, thereby engaging family members who may not otherwise be interested in the charitable family account’s core mission.

- Create a junior board of directors to involve younger generations and offer them a platform for training in preparation for serving on the formal board.

Younger generations can learn the founders’ values by assuming active roles in a charitable family account’s management and direction.

These activities present a chance to include people from different generations and facilitate dialogue around real-life examples of the family’s core values and include the following:

- Working together to craft or refine a mission for the charitable family account.

- Discussing how to approach giving, e.g., supporting only one cause or many, to effect change in a chosen area.

- Selecting which specific nonprofit organizations to support and how.

- Reviewing grant applications from nonprofits.

- Evaluating the impact of nonprofit partners.

- Evolving the charitable family account’s mission to reflect changing times or new priorities in a way that is consistent with the family’s long-term values and the founder’s mission.

Articulating the founding intentions helps future generations in understanding and adhering to these wishes, offering guidance on operations. Incoming board members are likely to value a clear grasp of the founders’ aspirations. While many boards and/or family members may be inclined towards new philanthropic ventures in line with contemporary needs, they also prioritize honoring the founders’ wishes and safeguarding their legacies.

Family governance serves as a safeguard against potential conflicts and challenges in philanthropic endeavors.

By establishing mechanisms for addressing disagreements and managing expectations, families mitigate risks and foster a culture of collaboration and mutual respect. This proactive approach minimizes disruptions and strengthens relationships within the family and with external stakeholders, ensuring the sustainability of philanthropic efforts over time. Establishing clear roles, responsibilities, and accountability mechanisms streamlines decision-making processes and maximizes the impact of contributions.

As with many areas of philanthropy, this type of work can manifest in diverse forms and is constrained solely by the donors’ imagination. This work presents family members with opportunities to strengthen their social awareness and establish a legacy focused on benefiting society.

Moreover, it provides philanthropists and their families with the flexibility to enact change in a manner that aligns authentically with their values and goals.

Some examples include:

- Preserving cultural heritage, monuments, artwork, and ideals.

- Establishing prizes and awards to incentivize progress and innovation.

- Advocating for reforms within systemic institutions and processes.

- Funding research initiatives to drive forward thinking and foster innovation.

- Developing solutions for pressing societal challenges such as homelessness.

- Supporting efforts to eradicate diseases and improve public health.

- Addressing social injustices and promoting equity in both public and private sectors.

- Providing training and education in specialized fields or skills.

- Utilizing filmmaking, media, and entertainment to raise awareness about specific causes, social issues, and marginalized populations.

In conclusion, the intersection of family governance and philanthropy represents a blueprint for lasting impact, and Callan Capital is committed to guiding families through this transformative journey.

By emphasizing personalized support tailored to each family’s values and aspirations, we equip them with the tools and knowledge needed to manage their wealth proficiently, shape their legacy, and make meaningful societal contributions through philanthropy. As families embark on their philanthropic journey, defining values, setting goals, and involving all members in discussions are crucial steps to ensure alignment and maximize impact. With the guidance of experienced professionals and a commitment to shared values, families can leave a lasting imprint on society while fostering unity, purpose, and fulfillment across generations.

Sources:

Foundation Source https://publications.investmentsandwealth.org/iwmonitor/library/item/september_october_2023/4146079/

Disclaimer:

The information provided is for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Callan Capital’s views as of the date of distribution. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. Callan Capital does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Callan Capital is not responsible for the consequences of any decisions or actions taken as a result of the information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of Callan Capital. For detailed information about our services and fees, please read our Form ADV Part 2A, and our Form CRS, which can be found at https://www.advisorinfo.sec.gov, or you can call us and request a copy at (866) 912-4888.