Starting January 1, 2024, the Financial Crimes Enforcement Network (FinCEN) mandates many U.S. companies to report information on individuals who own or control them. This requirement aims to enhance transparency and prevent misuse of financial systems. Non-compliance can result in penalties, but the process is designed to be simple, secure, and free.

Purpose

The Corporate Transparency Act, passed in 2021, seeks to combat illicit activities like using shell companies. Treasury Secretary Janet Yellen emphasized that this measure is crucial for protecting economic and national security by creating a centralized database of beneficial ownership.

Who Must Report

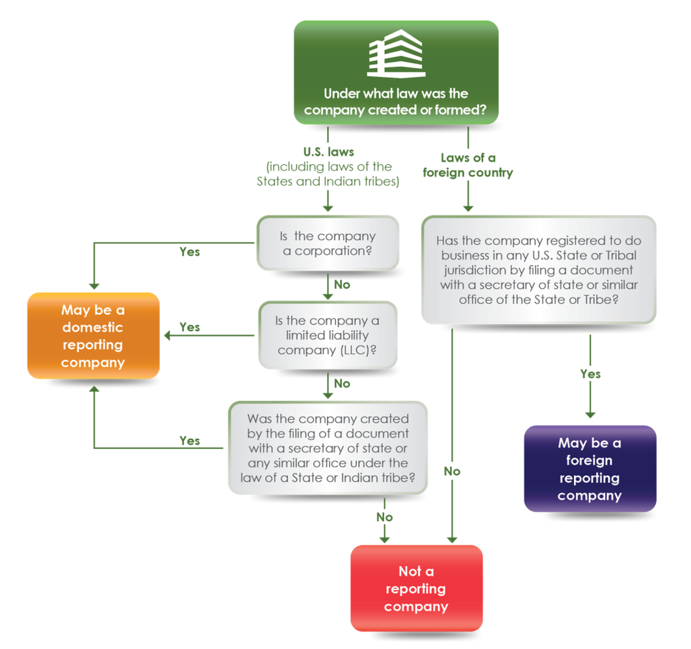

Two categories of reporting companies are:

- Domestic Reporting Companies: Includes corporations, LLCs, and others formed by filing with state offices.

- Foreign Reporting Companies: Entities formed under foreign law but registered to do business in the U.S.

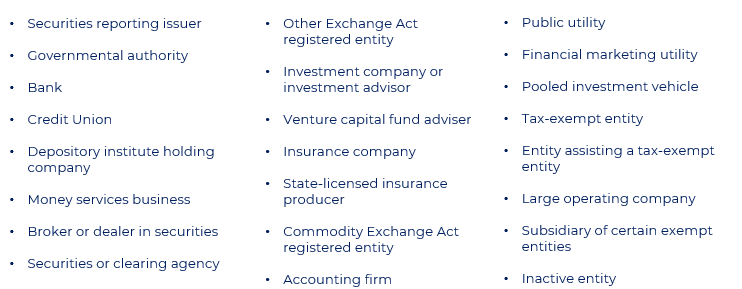

There are 23 types of exempt entities. FinCEN provides a compliance guide to help companies determine their status.

Source: https://fincen.gov/boi-faqs#A_2

FinCEN also offers a Small Entity Compliance Guide, which includes a flowchart, and advises companies to thoroughly assess their status before making a decision.

Source: https://fincen.gov/boi-faqs#A_2

Deadlines

- Companies formed before January 1, 2024, must file by January 1, 2025.

- Companies formed in 2024 have 90 days after receiving verification and that your company’s registration is effective.

- Companies formed after January 1, 2025, have 30 days to file post-verification.

Key Points

Businesses can authorize others to file on their behalf. The filing process is a one-time requirement unless updates are needed. Any updates to beneficial ownership information previously filed with FinCEN must be submitted within 30 days.

Disclaimer:

The information provided is for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Callan Capital’s views as of the date of distribution. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. Callan Capital does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Callan Capital is not responsible for the consequences of any decisions or actions taken as a result of the information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of Callan Capital. For detailed information about our services and fees, please read our Form ADV Part 2A, and our Form CRS, which can be found at https://www.advisorinfo.sec.gov, or you can call us and request a copy at (866) 912-4888.