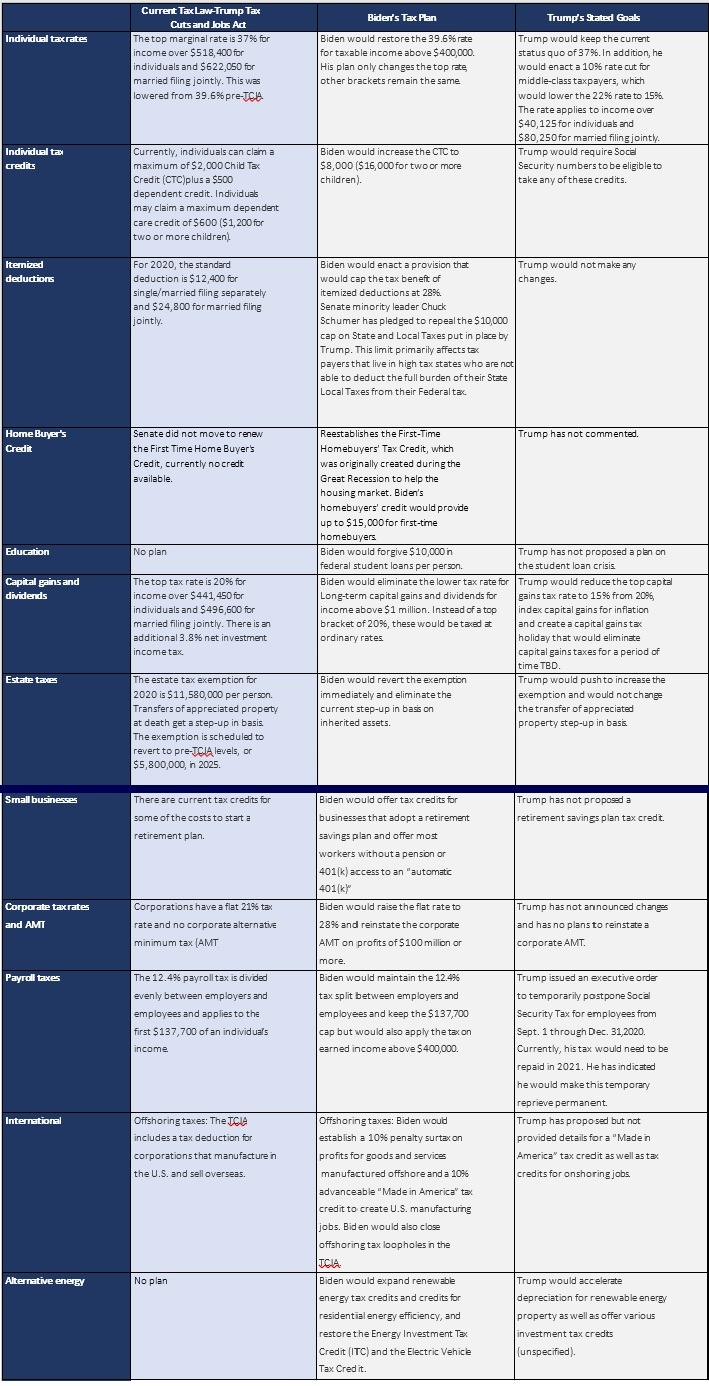

The US presidential election is shaping up to be likely one of the most contentious and consequential in modern history, making its potential policy, growth and market implications top of mind. Although President Trump hasn’t released a formal plan yet, he has generally expressed his intent to preserve, and expand on, the Tax Cuts and Jobs Act (TCJA) passed in 2017. Joe Biden has put forward a few proposals to raise revenue, as well as several proposals to provide targeted tax breaks for lower- and middle-class individuals while increasing taxes on those making over $400,000 per year as well as corporations. It’s also important to keep in mind the fundamental role of Congress in passing tax legislation. Depending on the makeup of the White House, Senate, and House of Representatives, passing tax legislation may be challenging. Below we have summarized the key points of each parties’ tax proposals.

Generally, it is not advisable to take any action now based on what might happen in the November election. However, we do know that regardless of the outcome of the elections; the winners won’t be taking office until 2021. It is prudent to have a strategy in place that you can execute if needed as the timeline will be tight, especially during a pandemic.

If Democrats take control of the White House and both chambers of Congress, year-end tax planning for high earners in 2020 will likely be all pulling forward as much income and as many deductions as possible. One of the most impactful pieces of Biden’s tax policy is the increase in taxes on capital gains for those earning over $1 million per year. If a taxpayer has income plus capital gains in a year that, when added together, exceed the $1 million mark, all capital gains above $1 million would be subject to ordinary income tax rates, as opposed to the current top capital gains rate of 20%. One way for high earners or those looking to sell highly appreciated assets to avoid those gains being taxed at the proposed new top rate of 39.6% is to sell those assets and realize gains in 2020–before the potential change in rates becomes effective.

Another major piece of Biden’s legislation would be the reduction of the estate tax limit. Clients who have estates over $5 million per person or who own hard-to-value assets, such as a private business, may wish to engage in gifting while the lifetime gifting limit is at $11.58 million per person. The IRS has already stated that it won’t ‘claw back’ previous transfers of assets if the exemption amount goes back to its pre-TCJA levels, so a client could choose to make a large gift now and lock in that higher exemption amount without triggering any transfer taxes.

Once a lower limit is in effect, clients will need to begin exploring more complex wealth transfer vehicles such as the use of Grantor Retained Annuity Trusts (GRATs), Charitable Lead Annuity Trusts (CLATs), and sales to Intentionally Defective Grantor Trusts (IDGTs).

Year-end Roth IRA conversions could also become a particularly attractive option for some high earners, as Roth conversions represent an easy way for a taxpayer to pull forward what would otherwise be future income into the current year. In this strategy, an individual would convert a portion of their traditional tax-deferred IRA into a tax-free Roth IRA and pay the taxes on the conversion in 2020. Once converted, Roth IRA distributions are tax-free while traditional IRA distributions remain taxed as ordinary income.

There are a lot of variables to consider and predictions, while helpful for planning, are only forecasts about what might be expected to happen in the future. We recommend you start planning now and wait until after the election to take action, if at all. We believe election year tax planning should be about speeding up or slowing down something you were already thinking about doing anyway. Don’t allow fear to cause you to take actions you would not have considered otherwise because even if your political calculations prove correct, that does not mean the expected tax policy will automatically follow. Anything can happen in politics. Our best advice is to start planning now but stay resilient and incorporate flexibility into your plans so they can accommodate different outcomes.

Important Disclaimer

Callan Capital does not provide individual tax or legal advice, nor does it provide financing services. Clients should review planned financial transactions and wealth transfer strategies with their own tax and legal advisors. Callan Capital outsources to lending and financial institutions that directly provide our clients with, securities based financing, residential and commercial financing and cash management services. For more information, please refer to our most recent Form ADV Part 2A which may be found at http://www.adviserinfo.sec.gov. The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices, and many consider it to be one of the best representations of the U.S. stock market.