How Callan Capital Helps Navigate High-Net-Worth & Ultra-High-Net-Worth Families Toward Strategies to Maximize Legacy Goals

Many people are catapulted into philanthropy because of a wealth event. Often, their first question is what giving vehicle to use to deploy their philanthropic dollars. We hope this third and final whitepaper in our series on How the Power of Philanthropy Strengthens Family Legacies will help you answer these questions:

- What are the types of giving vehicles, or structures, that I can use for my philanthropy?

- What are the pros and cons of each, given my interests and circumstances?

Helping to Creating Positive Change

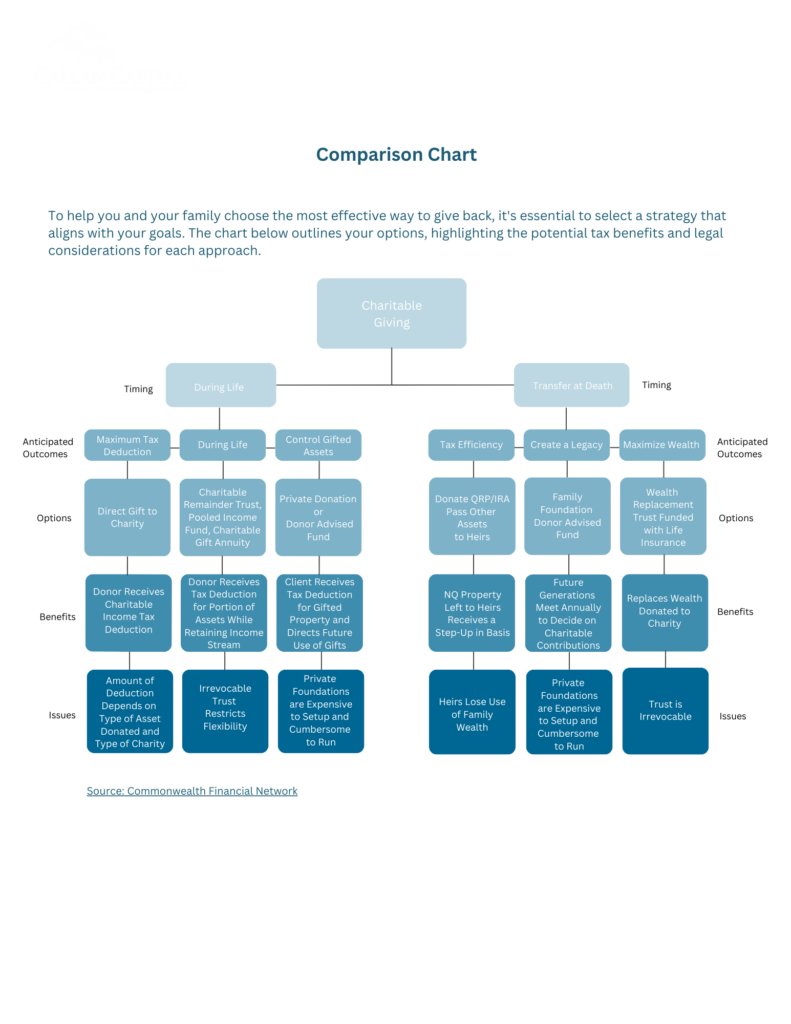

The natural inclination of people is to help others. That’s because we all have an innate desire to create positive change. The word philanthropy actually comes from Ancient Greek (“Philanthrôpía”) or ‘Love of Humanity.’ In a world marked by complex challenges and opportunities, dedicated individuals and innovative organizations are working tirelessly to make a difference. Their success often hinges on the support of philanthropic contributions to help transform ideas and intentions into meaningful, lasting impact. Before you make a donation or gift, however, it is important to choose the right strategy for your circumstances, especially one which pays close attention to the potential tax and legal implications of giving.

What is best for you and your family is a very personal decision. This guide endeavors to provide you with a variety of strategies, benefits, and implications of each type of giving. The four key types mentioned in this whitepaper include: direct charitable giving, donor advised funds (DAFs), private foundations, and charitable trusts. A chart at the end of the chapter compares the major characteristics of each vehicle.

Charitable Organization Vetting

While this whitepaper provides general details on tax deductible gifts, we recommend speaking to a trusted tax advisor if you have any doubts about the deductibility of a gift. The United States has over 1.8 million registered nonprofit organizations, including public charities, private foundations, and other types of nonprofits¹. (1-31-2023 – 12-31-2023).

It’s important to verify that the charitable organization to which you want to donate is an Internal Revenue Service (IRS)-approved charity. The IRS has an Online Search Tool that can help.

Charity Navigator² is another not-for-profit resource that posts financial reports and other information on tax-exempt U.S. charitable organizations. It uses data from the IRS, partners, and the charities themselves to power unbiased ratings so that you can give with confidence.

Charitable Giving Strategies

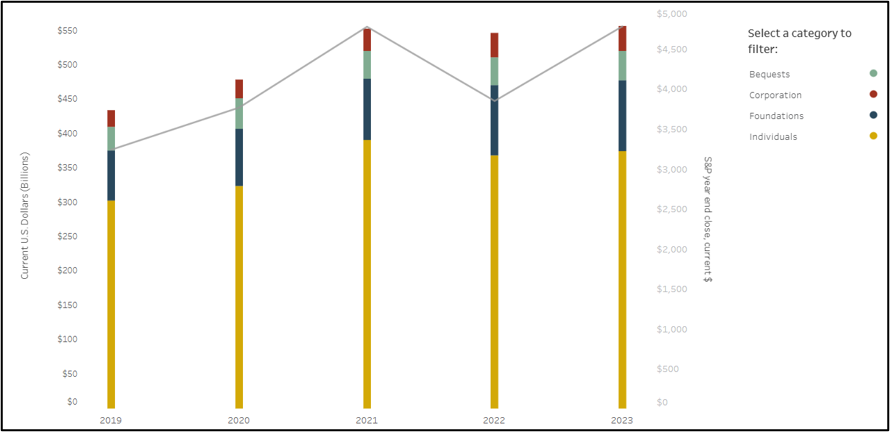

Last year, total estimated charitable giving in the U.S. topped $557 billion. (1-31-2023 – 12-31-2023). Nonprofits generate the majority of donations from four giving sources: lifetime gifts from individuals, bequests from individuals in wills and trusts, gifts from charitable foundations, and gifts from corporations. Although the largest contribution comes from individual lifetime gifts (67% of total contributions), the leading nonprofits draw from each of these sources for the most consistent year-to-year funding³. American generosity remains high even when markets are down.

Source: https://givingusa.org/giving-usa-limited-data-tableau-visualization ⁴ Dates as of 1/1/2019 – 12/31/2023

Encouraging Philanthropy Serves as a Powerful Way to Foster Unity Across Generations

In numerous high-net-worth (HNW) families, financial matters are often known only to a select few, limiting transparency and understanding within the family circle. However, philanthropic endeavors offer a platform for broader family engagement, facilitating the creation of a meaningful legacy grounded in purpose centered around common interests, values, and passions. It can help families:

- Identify core values.

- Uncover shared goals and passions.

- Increase multigenerational collaboration.

- Utilize assets in a way that creates impact.

- Align investments with intent.

- Cultivate skills in younger generations that prepare them for greater responsibilities within family enterprise.

Here at Callan Capital, we have created a Workbook for Family Philanthropy to help our families shape their Charitable Giving Policies, the latter which includes establishing the frameworks for regular family meetings. This was covered in the second whitepaper in our series on philanthropy: Navigating Family Governance: Why Family Meetings Matter.

Give Back and Get More: How Donating to Charity Can Benefit Your Taxes

As we transition from emphasizing the pivotal role of philanthropy in fostering family unity, it’s crucial to explore the diverse avenues through which families can engage in charitable endeavors. While direct donations to charitable organizations are prevalent, they represent just one facet of philanthropic involvement. Various strategies and vehicles exist, each offering distinct advantages and considerations. Choosing the most appropriate approach tailored to individual circumstances can optimize the impact and efficiency of charitable giving efforts.

I. Charitable Giving During Your Lifetime

There are a variety of giving vehicles that can support the strategy of charitable giving during your lifetime. The following are three key types to consider in your planning:

1. Donor Advised Funds

A donor-advised fund, or DAF, is a charitable giving mechanism sponsored by a public charity. It enables you to make an irrevocable contribution to that charity, making you eligible for an immediate tax deduction. Subsequently, you can suggest grants to any IRS-qualified public charity over time. The initial contribution required to establish a DAF can be relatively minimal when compared to other giving vehicles. It can also be used to create a pool of money that will encourage giving by your family for generations to come.

Features / Benefits:

- Take an immediate tax deduction for your charitable contribution.

- Can receive a charitable deduction of 60% Adjusted Gross Income (AGI) for cash and 30% AGI for long-term capital gain property. The deduction is calculated on the full market value of the security.

- The deduction equals the fair market value of the gifted cash or property in the year the gift is made. The total deductibility of gifts in any given year is subject to the same limitations as gifts made outright to a public charity.

- If the full deduction cannot be taken in the year of the gift because of AGI limitations, the donor may carry forward the unused deduction for five years.

- Also, donors can avoid capital gain taxes on gifts of appreciated assets to the DAF. This offers a one-two punch for donors. Donors can deduct their contribution to the DAF. This further reduces their taxable income by donating appreciated property at fair market value because no capital gain is realized. Property must have been held more than one year before the contribution or be subject to the donor’s cost basis.

- Support the charities you care about right away or over time.

- Ongoing contribution and subsequent grant recommendation process is easy with a DAF.

- Potentially grow your donation tax-free by recommending how the funds should be invested until a grant is made.

- Streamline your recordkeeping and consolidate tax receipts, all in one centralized, online location.

Considerations:

- When you choose where to make grant recommendations, the sponsoring charity has ultimate control over the grants.

- Sponsoring charities of the DAF are required by law to ensure that grants are only made to qualified charities and are used exclusively for a charitable purpose. Consequently, grants cannot be used to support non-501(c)(3) entities or be used to satisfy binding pledges.

2. Private Foundations

A private foundation is a charitable organization typically established by an individual or family with a substantial initial gift. Private foundations are overseen by a board of directors or trustees responsible for receiving charitable contributions, managing, and investing charitable assets and making grants to other charitable organizations.

Features / Benefits:

- Establish a legacy beyond your lifetime and allow family members to be employed or serve as members of the governing board.

- State and federal regulations allow foundations to pay a salary to those who provide services to the foundation, even family members, as long as these individuals are qualified for the position, the compensation is reasonable and necessary, and the foundation follows the rules governing compensation to insiders.

- Foundation members may pay for reasonable and necessary expenses associated with running the foundation. Expenses that can be reimbursed by the foundation include board meetings, administration, site visits, travel expenses, and even costs associated with starting the foundation.

- Potentially generate more assets through investment management to support the private foundation’s charitable mission.

- With full control over grant-making, you can support more than just 501(c)(3) charities. By following proper IRS-procedures, grants can be made to additional causes including charitable programs undertaken by individuals, making loans and loan guarantees, scholarship programs, providing funding to for-profit businesses that support the foundation’s charitable mission, and supporting organizations based outside the U.S.

Considerations:

- Generally, requires a substantial initial contribution.

- Charitable deductions are limited to 30% AGI for cash and 20% AGI for long-term publicly traded appreciated securities, as compared to the higher 60%/30% limits with some other charitable vehicle options.

- Non-publicly traded contributions, such as privately held stock or real estate, may only be deductible at basis rather than fair market value.

- Administratively complex and require legal setup and ongoing maintenance, including annual filings and other reporting, eliminating the option to give anonymously.

- Require a 5% distribution of assets each year.

- While private foundations are exempt from federal income tax, the investment income is subject to a 1% or 2% excise tax.

3. Qualified Charitable Distributions (QCDs)

A qualified charitable distribution (QCD) is an important tool that lets donors age 70½ or older help charities of their choice and reduce their tax burden in three ways: lower their taxable income, reduce the required minimum distributions (RMDs) that can increase their income, and reduce future tax burdens to heirs.

Features / Benefits:

- You must be age 70½ or older to make a QCD.

- If certain conditions are met, QCDs also can count toward the required minimum distributions (RMDs) that people who are age 73 or older must meet each year if they have traditional IRAs (or a number of other tax-advantaged retirement plans that you can’t use for a QCD).

- You don’t have to itemize your tax return to take advantage of a QCD. While a QCD is a withdrawal from your IRA, it is not counted as taxable income on your tax return like regular withdrawals are. Instead, a QCD can be deducted from your gross income on your tax return—without having to itemize your deductions. This lowers your income and means that you can take the standard deduction instead of itemizing if you prefer.

- The problem with taking RMDs from traditional IRAs (and other qualified retirement plans) is that they increase your taxable income. Depending on your situation, they can push you into a higher tax bracket. Using qualified charitable distributions could fulfill all or part of your RMD requirement without increasing your taxable income.

- A non-spousal beneficiary of an inherited IRA can make a qualified charitable distribution (QCD) if they are at least 70 1/2 years old too.

Considerations:

- The donation must go to a qualified charity.

- The donation must come directly from the individual retirement account (IRA) through your trustee to the charity; you cannot withdraw the funds and make the donation directly.

- The maximum annual QCD limit is $105,000 in 2024 and $108,000 in 2025.

- A QCD must come from an IRA and not a qualified retirement plan.

- To reduce an RMD, a QCD must be made ahead of taking the RMD.

- Philanthropists can combine QCDs with other direct transfer giving strategies of long-term capital gain property to maximize 30% of AGI limits.

II. Charitable Giving While Generating Income

Some charitable solutions can support dual objectives of generating income while also pursuing philanthropic goals. Charitable trusts offer flexibility and some control over your intended charitable contributions as well as lifetime income, thereby helping with retirement, estate planning and tax management.

There are two different types of charitable trusts, charitable remainder trusts (CRTs) and charitable lead trusts (CLTs). Both types of trusts “split” the assets between charitable and non-charitable beneficiaries. Which type you choose depends on your priorities with respect to estate planning and wealth preservation and how you want the charity to receive the gift.

A. Charitable Remainder Trust (CRT)

There are two main types of charitable remainder trusts:

- Charitable remainder annuity trusts distribute a fixed annuity amount each year, and additional contributions are not allowed.

- Charitable remainder unitrusts distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made. Both are an irrevocable transfer of cash or property and are required to distribute a portion of income or principal to either the donor or another beneficiary. At the end of the specified lifetime or term, the remaining trust assets are distributed to a charitable remainder beneficiary.

Benefits:

- Preserve the value of highly appreciated assets by contributing the asset to the CRT, sell it within the trust as tax-exempt and eliminate large capital gains taxes, thereby donating the full value of the property to the CRT.

- Immediate potential to take a charitable deduction against the income or gift tax for the present value of the trust’s assets that are to pass to the qualified charity (the remainder beneficiary).

- Investment income is exempt from tax. This makes the CRT a good option for asset diversification. You may consider transferring low-basis assets to the trust so that when sold, no income or capital gains tax is recognized on the sale. However, the named non-charitable beneficiary will pay income tax on the income received.

Considerations:

- Per the IRS, the annual annuity must be at least 5% but no more than 50% of the trust’s assets.

- A trust’s term may be fixed but can be no longer than 20 years, or it can be for the life of one or more non-charitable beneficiaries.

- There are some types of assets that should not be used to fund a CRT, including S corporation stock, since a CRT is not an eligible S corporation shareholder.

- CRTs require legal setup and ongoing maintenance costs.

B. Charitable Lead Trust (CLT)

A charitable lead trust is the inverse of a CRT. It’s an irrevocable trust that generates a potential income stream for the named charitable beneficiary, with the remaining assets eventually going to family members or other beneficiaries. Charitable lead trusts are not tax-exempt, and you will need to decide the tax treatment of the trust when it is created.

There are two types:

- Non-grantor lead trust: The trust’s income each year is not taxable to the grantor (the person who funded the trust). In this case, you will not receive an income tax deduction for creating the trust. The trust pays tax on the income, and the trust claims a charitable deduction for the amounts it pays charity.

- Grantor lead trust: In a grantor CLT, the grantor can take an immediate charitable contribution deduction for the present value of the future income stream, subject to applicable percentage limitations depending on whether a public charity or a private foundation is the beneficiary. However, this benefit is mitigated by the fact that the trust income is taxable to the grantor during the term with no offsetting of future charitable deductions as the amounts are paid to the charity.

Benefits:

- Donors choose the terms of the trust, and the amount distributed, at least annually, to charity.

- Assets used to fund a charitable trust are removed from your estate and may not only reduce the amount of tax your estate has to pay upon your death but may also preserve funds for your heirs.

Considerations:

- A CLT is not tax-exempt. Trust income is taxed like the income of any other complex or grantor trust.

- Requires legal setup and ongoing maintenance costs.

III. Charitable Legacy Planning

Many people have the goal to extend their tradition of giving beyond their lifetime. Let’s review three key strategies:

1.Charitable Bequests

- As you plan for philanthropic support as part of your legacy, a charity (including a DAF) can be named as the beneficiary of a will or a revocable or irrevocable trust.

- As noted above, vehicles such as DAFs and private foundations can also be used to enable family members to continue philanthropy after your lifetime thereby furthering your charitable legacy across generations.

2. Beneficiary Planning for IRAs and Qualified Retirement Plans

- Retirement assets may be good candidates for charitable bequests after death, because they can be among the highest taxed assets in any estate. Leaving your retirement assets to a charity offers two distinct advantages:

- Increases the impact of your legacy, as the charity is not required to pay income taxes on donations from retirement account assets.

- Decreases the estate tax burden for your family. Your retirement assets pass directly to the charitable organization, so the distribution to charity is generally deductible due to the unlimited estate tax charitable deduction.

3.Wealth Replacement Trusts

- Finally, life insurance can be used to fund a Wealth Replacement Trust with the goal of replacing wealth to family for assets donated to charity.

- Individuals may set up irrevocable trusts for philosophical reasons. For example, they may wish to keep a set financial policy in place, or they may wish to maintain core values intact for future generations. For example, an irrevocable trust may stipulate limited distributions to beneficiaries each year, to ensure that beneficiaries build their own sources of revenue and don’t solely rely on inherited wealth. Such action promotes fiscal responsibility, while reducing the ability of an heir to squander their newly-inherited assets.

- Irrevocable trusts also have several tax perks. By eliminating all incidents of ownership from estate taxes, they effectively remove the trust’s assets from the grantor’s taxable estate. Furthermore, irrevocable trusts can relieve a grantor of tax liability on any income the assets generate.

- This sharply contrasts with revocable trusts, in which grantors can alter or cancel any provisions. During the life of the revocable trust, the grantor may receive distributions of income from the trust. While it does not offer the same tax advantages as an irrevocable trust, revocable trusts will be transferred to the beneficiaries, immediately upon a grantor’s death. In another scenario, a grantor might use an ILIT to support charitable causes in addition to providing for their family. In that case, the grantor could specify that a portion of the life insurance proceeds be distributed to selected charities.

- The tax consequences vary, based on how you choose to fund the trust: either by transferring an existing life insurance policy to the Trust; or by transferring money to the Trust so the Trustee can purchase a new life insurance policy.

- A philanthropic strategy incorporating an ILIT is just one-way families can help to accomplish key estate-planning goals like asset protection, tax minimization and efficient wealth transfer.

In conclusion, at Callan Capital, we treat you like family and are committed to putting your interests first. Knowing that you have access to a wealth of knowledge and solutions during your life and beyond from an advisor dedicated to advocating for you can make all the difference.

Identifying and prioritizing what matters most to you is all part of building trust – the more we understand your financial situation and life goals, the deeper our level of advice. We want you to know you can call us, not only for wealth management, but for everything in between, from selling a business to navigating a challenging life event to retiring to continuing to make a difference in families and communities for future generations.

As part of our personalized process, we’ll work with our in-house teams to create a wealth management strategy flexible enough to change along with you. We can help you understand the alternatives, as well as the costs and the ongoing responsibilities of administering a consistent strategy, based on your unique needs and goals.

Sources:

1.Giving USA 2024: The Annual Report on Philanthropy for the Year 2023. A public service initiative of The Giving Institute. As of 1-31-2023 – 12-31-2023.

3.https://www.privatebank.citibank.com/newcpb-media/media/documents/insights/Philanthropy-and-global-economy.pdfhttps://urbaninstitute.github.io/nccs/

4.Giving USA 2024: The Annual Report on Philanthropy for the Year 2023. A public service initiative of The Giving Institute. As of 1-31-2023 – 12-31-2023.

Disclaimer:

The information provided is for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Callan Capital’s views as of the date of distribution. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. Callan Capital does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Callan Capital is not responsible for the consequences of any decisions or actions taken as a result of the information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of Callan Capital. For detailed information about our services and fees, please read our Form ADV Part 2A, and our Form CRS, which can be found at https://www.advisorinfo.sec.gov, or you can call us and request a copy at (866) 912-4888.

Disclaimer:

Disclaimer: Callan Capital outsources individual tax, estate planning, legal advice, family financial accounting, personalized concierge services, identity theft protection and financing services. Clients should review planned financial transactions and wealth transfer strategies with their own tax and legal advisors. Information contained herein should not be constituted as advice to implement any financial strategy. Clients should review planned financial transactions and wealth transfer strategies with their own tax and legal advisors. Callan Capital outsources to lending and financial institutions that directly provide our clients with securities-based financing, residential and commercial financing and cash management services. For more information, please refer to our most recent Form ADV Part 2A which may be found at www.adviserinfo.sec.gov.QRP – Qualified Retirement Plan; IRA – Individual Retirement Account; NQ Property – Non-Qualified Property.