Q3 Market Update

After solid performances in both July and August, the S&P 500 ended September 4.8% lower, its first monthly drop since January and the biggest since March 2020, at the onset of the COVID 19 pandemic.

There are plenty of possible explanations for the market’s diminished presence:

- Delta Variant

- Potential default of Evergrande

- Pending Congress legislation & the national debt crisis

- Concerns about inflation and supply chain issues

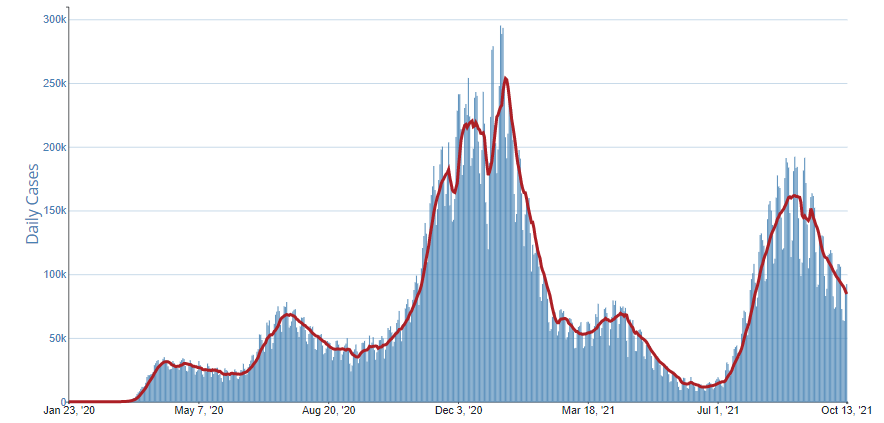

Delta Variant

The momentum of the U.S. economic recovery slowed in the third quarter as a surge of Delta variant infections led to a deceleration in economic activity in industries such as travel, restaurants, and tourism. Fortunately, COVID 19 cases, hospitalizations, and deaths are once again declining in many parts of the country. Vaccines are working and boosters are becoming widely available.

The current 7-day moving average of daily new cases (84,555) decreased 12.5% compared with the previous 7-day moving average (96,666) for the week of October 6 – 13. A total of 44,615,528 COVID-19 cases have been reported as of October 13, 2021.

Source: www.cdc.gov as of October 13, 2021

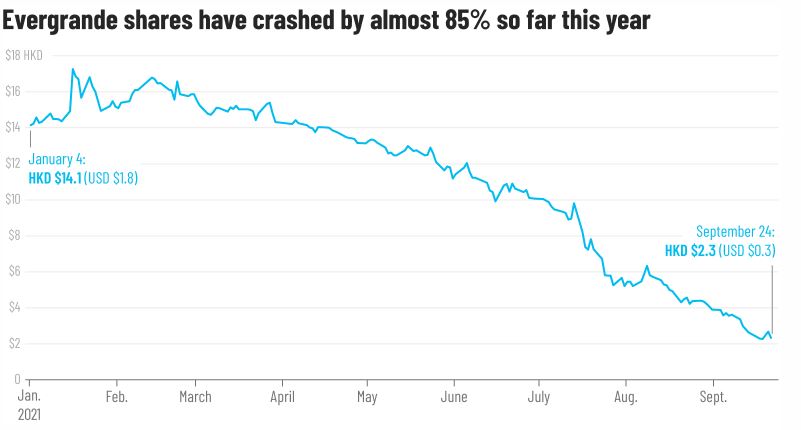

Evergrande

Globally, markets were shaken by the potential collapse of Chinese property magnet, Evergrande. The Chinese and Hong Kong markets were unstable throughout the month while they waited to hear the fate of Evergrande’s debt. With a staggering $300 billion in outstanding debt, the company’s potential failure risk set off a chain reaction in China and overseas markets. About 67% of Evergrande’s debt is cash that customers have paid towards property that is still under construction. Evergrande is currently attempting to sell assets in order to raise the cash needed to meet its debt obligations.

Source: CNBC as of September 24, 2021

Congress

Investors kept their eyes on Washington, while Congress debated extending the national debt limit. The House of Representatives approved an extension of the nation’s debt limit through early December to avoid catastrophic default and economic disaster.

Details on the much-debated budget reconciliation bill emerged and provided the first detailed look at the major tax provisions affecting large corporations and high-income households.

Proposed tax policy changes include:

- A 15% corporate minimum tax that could affect companies that are profitable but report low tax rates

- U.S.-based multinational companies could face a different 15% minimum tax on their foreign income. They could pay at least 15% in each country in which they operate

- For individuals, the plan includes a 5% surtax on adjusted gross income above $10 million and an additional 3% on adjusted gross income above $25 million

- High-income business owners could face a 3.8% tax on active business income

- Corporate stock buybacks could face a new 1% excise tax

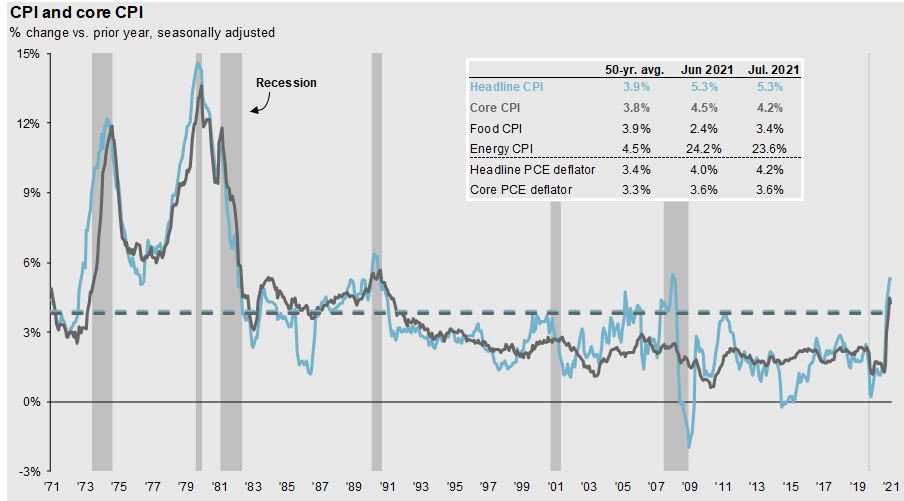

Inflation & Supply Chain Issues

This year’s inflation jumps were largely caused by a combination of factors - a spike in the prices of products that are in high demand as the pandemic lockdown restrictions loosened, supply chain disruptions, and monetary relief benefits that are keeping some workers at home rather than back to work.

The biggest increase in prices is noted in oil and gas, with a barrel of oil sitting at $80/barrel at the beginning of Q4/2021. But it is not only oil and gas, our basic goods like produce and meat are also becoming more expensive.

Consumer spending has further been inflated by temporary payments disbursed through various pandemic fiscal programs which expired in September.

Source: JPM Guide to Market as of August 31, 2021

There is still a silver lining to the headwinds described above. The economy appears to have a supply problem, not a demand problem. Recession usually begins when we have excess supply and falling demand. Demand has been rising most of 2021. These savings do not include the increased wealth effect from the large gains in stocks and real estate.

Our base case is that the pandemic has ironically prolonged this expansion by taking the world offline for two years; removing excess supply in the system while demand has continued to rise, stoking supply chain bottlenecks and increasing the demand side of the equation. We believe that if this current bottleneck in the supply chain is resolved, the demand will take time to meet, creating a continuation of this economic recovery. Despite the Q3 weakness, we expect the U.S. to bounce back in the fourth quarter and continue growth into 2022.

Disclaimer

The information provided is for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Callan Capital Management’s views as of the date of distribution. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. Callan Capital does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. Callan Capital has obtained the information provided herein from various third-party sources believed to be reliable but such information is not guaranteed. Callan Capital makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Callan Capital is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of Callan Capital Management. For detailed information about our services and fees, please read our Form ADV Part 2A, and our Form CRS which can be found at https://www.advisorinfo.sec.gov or you can call us and request a copy at (866) 912-4888